|

1. Press Release: Dr. Ako Doffou receives the prestigious Distinguished Scholar Award 30.10.2020

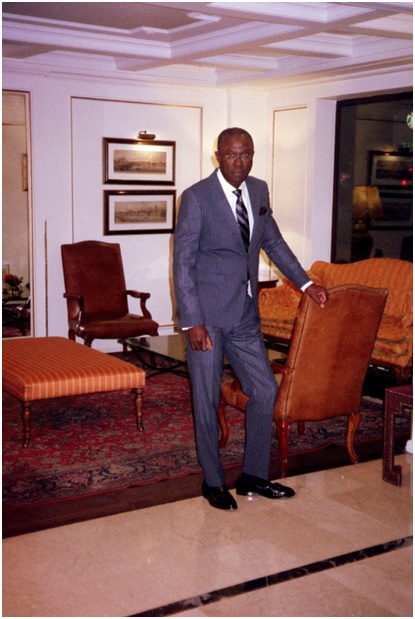

Dr. Ako Doffou receives the prestigious Distinguished Scholar Award

International Research Journal of Finance and Economics pays tribute to Dr. Doffou’s contribution to the field of Finance through his article titled “Tests of the Stochastic Volatility with Jumps Model Driven by Moment Swaps”

Dr. Ako Doffou, who is affiliated with the Department of Finance, School of Business, Shantou University Shantou, Guangdong, China is one of the recipients of the Distinguished Scholar Award in 2020. With this award, the independent ad hoc Scientific Award Committee and the Editorial Board of the International Research Journal of Finance and Economics pays tribute to Dr. Doffou’s contribution to the field of Finance through his scientific article titled “Tests of the Stochastic Volatility with Jumps Model Driven by Moment Swaps”.

Professor Adrian Marcus Steinberg, the Chair of the Independent ad hoc Scientific Award Committee, said:

“Dr. Ako Doffou has received the prestigious Distinguished Scholar Award 2020, because he has made a significant contribution to the existing knowledge in his selected area of research. His outstanding research provides the evidence for the importance of considering stochastic volatility, random jumps, and higher-order moment swaps in the pricing and hedging model. The results of his research show that adding jump components to a stochastic volatility model in a market enlarged with higher-moment swaps leads to a more realistic modeling of conditional higher moments as well as the moneyness and maturity effects, an improvement of the modeling of the term structure of the conditional variance, and a superior model pricing performance.”

The Distinguished Scholar Award is a prestigious academic recognition that have been presented to a very limited number of scientists from around the world since 2004 regardless of which scientific journal they have chosen as an outlet for their research. Selection of candidates are based on their outstanding scholarly contribution to the scientific knowledge in their fields of scientific research with respect to a set of criteria, including the overall importance of the research question or problem and level of innovation in the topic, the effectiveness and novelty of the methodology and data employed, academic significance and usefulness of conclusions resulting from the research, adequacy of the critical review of relevant literature and the broad application of the findings.

Dr. Doffou’s paper tests the pricing accuracy and the hedging performance of the stochastic volatility with random jumps model in markets extended to contain swap contracts whose payoffs depend on the realized higher moments of the state variable. Using a two-step iterative approach, latent model variables are first filtered and then used to estimate the model parameters. The tests on European options and variance swaps written on the S&P 500 index show superior pricing accuracies in-sample and out-of-sample and jump risk is priced. Hedging strategies involving higher-order moment swaps perform better across all moneyness and maturity classes.

Moment swaps are derivatives whose payoff depends on the realized higher moments of the underlying state variable. This payoff depends on the powers of the daily log-returns and allows moment swaps to provide protection against various types of supply and demand shocks in capital markets. Variance swaps are created in the case of squared log-returns. Variance swaps are today liquidly traded, driven by different types of state variables and offer protection against the volatility regime fluctuations. In addition to the variance, skewness, kurtosis and higher-order moments play important roles in the distribution of asset prices. Higher-order moment derivatives can be useful to protect against inaccurately estimated higher moments such as skewness and kurtosis.

Tests of the Stochastic Volatility with Jumps Model Driven by Moment Swaps

|